Giving

Thank you for your Generosity

Your gifts support the ministry and mission of Newlonsburg Presbyterian Church.

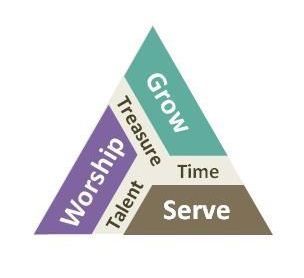

By sharing our time, talents, strengths and treasures wholeheartedly, we can be good stewards of God’s grace and help to spread Christ’s love and build the Kingdom.

for giving questions,

please email: npcgiving@gmail.com

Ways to Give

Online Giving

The easiest way for you to give is thru Realm, our secure online community. We recommend that you consider setting up a recurring donation through your Realm profile.

Text Giving

Text "Newlonsburg" to 73256 to complete a gift.

Cash & Checks

Checks may be made out to Newlonsburg Presbyterian Church and placed in the offering plate or mailed to: 4600 Old William Penn Highway, Murrysville, PA 15668. Please include your member number (if applicable) in the memo line.

Automatic Bill Pay is another great way to give regularly and consistently. Each bank is set up slightly differently, so you will need to contact your bank for specific instructions.

Gifts of Stock

Transferring appreciated stocks, bonds, and mutual funds, is a great option for charitable giving. Gifts of appreciated securities owned more than one year can provide additional tax savings by decreasing long-term capital gains and through itemized deduction of the current value, rather than the initial cost. You should consult with your personal tax and legal advisors about the impact of making such gifts to see if this option is appropriate for you.

Legacy Giving

NPC has two endowments: The Legacy Fund and The Presbyterian Foundation Endowment. You can donate directly to one of these funds or name one of our funds to your list of BENEFICIARIES in your estate planning documents. Please contact the Endowment Committee with any questions.

Qualified Distributions

Using a Qualified Charitable Distribution (QCD) is a great way for people meeting certain requirements with an IRA and a need to withdraw funds to meet a Required Minimum Distribution (RMD), to contribute to NPC.

If making a QCD, many organizations offer free Electronic Funds Transfer (EFT). This moves the donation directly between accounts and is more secure than mailed checks.

Raise Right

The RaiseRight (formerly Script) gift card rebate program is up and running at NPC. Members are participating by buying gift cards and NPC gets rebates. When you purchase gift cards (retail, gas, travel, groceries, etc. over 750 retailers) using the program, you receive the face value of the gift card and NPC receives a rebate of 2.5% to 14%. For example, if you purchase a $100 gift card through the program (note: you also pay a small t transaction fee), you receive the $100 gift card and NPC receives $7. Most retailers offer instant online options. For additional details and lists of retailers, please visitwww.raiseright.com. Currently, NPC is limiting this program to electronic gift cards.

Employer Matching

Many companies offer matching gift programs to encourage employees to contribute to charitable organizations.

If your employer does not match gifts to religious organizations, consider matching your contributions to these other organizations.

Pre-Tax Giving

Many employers offer the option to make charitable contributions to the United Way through payroll deductions. Newlonsburg Presbyterian Church can be designated for the United Way contributions. This could be a way to make pre-tax contributions to NPC.

Connect App

Download the Realm Connect app. Login with your Realm account to give. The Realm Connect app also allows you to setup a recurring donation.